LEAD GENERATION FOR THE FINANCE INDUSTRY

How to attract customers in the Finance Industry?

Learn how to successfully attract customers in the Finance Industry

226 thous.

people in managerial positions that you can reach in the finance industry

710 thous.

companies operating in the finance industry

35

campaigns successfully realized in the finance industry

Lead Generation for Financial Services

The financial industry is a dynamic and complex market that plays a key role in the economy and the functioning of society in general. Thanks to the development of technology, the sector is constantly evolving, bringing new financial products and services to the market. Contemporary trends in the industry include the development of blockchain technology, cryptocurrencies, fintech and the growing role of sustainability and responsible investment.

Like any other industry, it also faces challenges in acquiring b2b leads. One of them is the high competition in the market. Due to the large number of players offering various financial services, finding your niche and standing out from the competition is difficult. Additionally, due to the sensitivity of financial data, building trust with potential B2B customers is crucial, but takes time and effort.

That’s why, as InStream Group, we tailor our b2b lead generation strategies to help our clients overcome these challenges. Thanks to the experience we have gained in implementing projects in the financial market, we are able to offer effective and flexible solutions to help our clients increase sales. Our solutions are based on our client’s specific needs and market requirements, which enables us to operate effectively in this sector.

NEW MARKETSOur experience in generating leads in the financial industry

We are an agency specializing in B2B lead generation through Cold Mailing and Social Selling on the LinkedIn platform. We have already worked with many companies in the financial sector, implementing lead generation campaigns. Our experience reaches more than 1,000 completed campaigns in more than 50 markets worldwide.

During the implementation of the campaigns, we carefully verify the companies according to the specified criteria. In the case of the financial industry, we are primarily guided by the company’s turnover and number of employees, as well as positions (most often Chief Operating Officers, Chief Financial Officers and CEOs), which allows us to create a precise and valuable database of potential B2B customers.

Until now, b2b lead generation campaigns in the financial sector have mainly focused on:

-handling online payments, payment gateways, cryptocurrencies,

-accounting services, financial advisory support,

-tax optimization, accounting for EU funds,

-obtaining EU funds for investment,

-encouraging investment in stock exchanges,

-support in reaching investment funds.

Contact us to find out how we can together accelerate the development of your business in the dynamic world of finance.

OUR CUSTOMER ACQUISITION METHODSCold Email and Linkedin Social Selling for the Financial Industry

What exactly is Cold Email and Linkedin Socia Selling?

Cold Email is a form of communication that involves sending personalized emails to potential customers who have not yet had contact with your company. Through the use of cold email, we are able to reach potential customers whose business profile may require relevant support, such as finance and consulting. This kind of target can look like the following: reaching owners and CFOs, working in the automotive sector, located in Germany, with up to 50 employees.

The second method is LinkedIn Social Selling, i.e. using LinkedIn to attract potential customers. Using this tool, we are able to effectively connect with our target audience by direct messages and posting to build brand image and brand position. In addition, by being active on LinkedIn, financial companies can build trust, which is so important during the purchasing decision for potential customers in this sector.

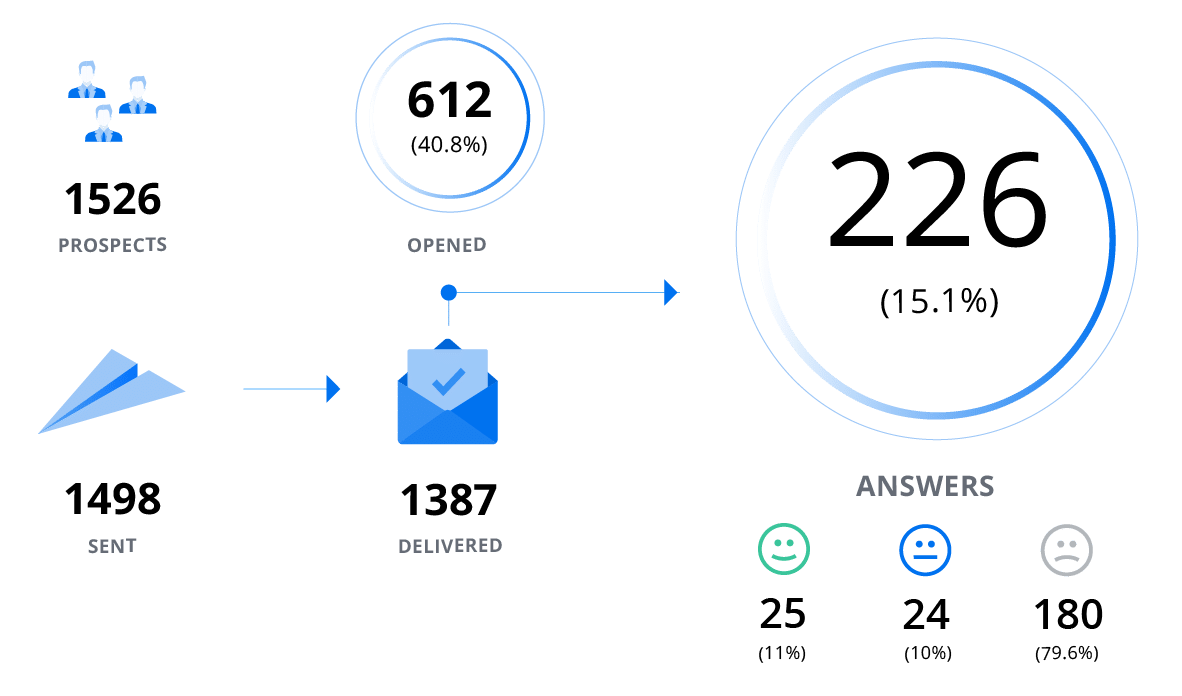

WE HAVE EXPERIENCECase Study of Cold Email Campaign for a Financial Company

Working with a financial company offering debt collection support, we focused on reaching CEOs, CFOs, COOs and Debt Collectors working in 10 specified sectors, also taking into account location.

As part of the campaign, we conducted a needs analysis to better understand the client’s expectations for cooperation. The next step was to precisely define the target and prepare a personalized database of companies, which consisted of carefully selected contacts. We then developed a sequence of personalized Cold Email messages and carried out the mailing. Throughout the project, a dedicated Project Manager coordinated the campaign, making sure the best possible results were achieved.

As a result, we acquired 25 people interested in cooperating with our client.

GENERATED HOT LEADSResponses you can expect

Good morning,

I am glad that you contacted me. We are currently looking for a solution to help us optimize our financial processes. Can we arrange a meeting, tomorrow at 11:00 am?

Greetings

Hello,

would you be able to send me more information about your offer and what benefits I could achieve by cooperating with your company?

Greetings

Good morning,

I am interested in cooperation in the field of reaching out to investment funds. Please provide me with more details about the services you offer and your past work in this area.

Best Regards

GET READY TO HANDLE LEADSWhat questions might a potential customer interested in finance support ask?

During the process of acquiring customers in the financial sector, questions often arise about the services offered. They may be asked while the Cold Email campaign is in progress or during an arranged conversation. It is a good idea to answer them honestly and accurately so that potential customers have a full understanding of your services.

- What specific financial services do you offer?

- What benefits can I get from working with your company?

- Are you able to offer solutions tailored to the specifics of my business?

- What are the costs of your services and what are the payment terms?

- Do you have experience in my industry?

- What are your credentials and past successes in providing financial services?

- What tools and systems do you use in your work?

- What is your approach to working with clients?

- What are the terms of the contract and how long does a typical contract last?

- What documents and information will be required of me as part of the cooperation?

MAKE 100% USE OF THE CAMPAIGNHow to handle hot leads from Cold Email campaigns in the financial industry?

In order to fully maximize the potential of a Cold Email campaign, it is also necessary to take care of effective lead processing. In this case, you can use an outsourced so-called pre-salesman or appoint an internally dedicated salesman to handle leads from Cold Email campaigns.

What is worth keeping in mind when handling a Hot Lead?

First and foremost, it is important to respond quickly to their needs. The longer we delay responding, the more likely the customer will decide to go to a competitor. A good practice is to arrange a short phone call or meeting with the customer to discuss the details of the offer.

During the conversation, ask questions aimed at understanding the customer’s needs and expectations. It is important not only to present your solutions, but also to listen and adapt them to the customer’s individual needs.

Once the conversation is over, it’s a good idea to send a confirmation of the meeting or further information about the offer. It is also important to remember to contact the customer regularly to maintain a positive business relationship with them.

OVER 1 000 COMPANIES FROM ALL OVER THE WORLD TRUSTED USMeet our clients from the Finance Industry

We implemented Cold Email campaign for Dotpay to acquire B2B customers. The target group was decision-makers on the positions of: CEO, CFO and E-commerce Manager, E-commerce Sales Director, On-line Shop Manager. The project gained a lot of responses and was successful.

Invest in your sales team

Complete the form. We will contact with you within 10 minutes.